Baby Apparel Market Size, Share & Trends Analysis Report By Product (Outerwear, Underwear), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2019 - 2025

- Published Date: Sep 2019

- Report ID: GVR-3-68038-669-1

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Data: 2015 - 2017

Industry Insights

The global baby apparel market size was valued at USD 135.5 billion in 2018. Rising awareness regarding the safety and comfort of the baby is projected to be a key factor for the market growth over the forecast period. In addition, parents are focusing not only on easy and convenient baby dressing but also on style in accordance with the latest fashion trends. These consumer trends are anticipated to play a key role in expanding the market scope of various baby apparel variants over the next few years.

The parents are becoming more aware of those apparel products, which provide comfort to the baby, along with improving the adaptability of the latter around their surroundings. Additionally, parents, as well as babysitters, are more concerned about convenient baby dressing care. They are choosing clothes that do not have any adornments such as buttons or fancy laces that could rip off and lead to any choking hazard, tripping, or strangling hazard.

Most of the apparel products are made from synthetic materials, which contain harmful chemical dyes and they lead to cause skin irritation in infants. These consumer trends are expected to expand the market scope of baby apparel, over the forecast period. The government of various countries is regulating thetextileindustry and framing new policies in order to make babies wearing apparel safer. The baby clothes should meet the flame-resistant requirements as prescribed by the government for their safety.

For instance, according to the United States Consumer Product Safety Commission, the regulation is established in three different classes of flammability based on the time of flame spread. Class 1 textiles have a flame spread time of more than 7 seconds, which makes them acceptable for use in apparel. Class 2 textiles have a flame spread time from 4 to 7 seconds and it is used to make gloves, footwear, and hats, where the flame-resistant factor is not required to meet these standards. Class 3 textiles have a flame spread time of fewer than 3.5 seconds, which makes them unfit for manufacturing baby apparel.

Product Insights

Outerwear baby apparel was the largest product segment, accounting for a share of more than 65.0% in 2018. New parents are focusing on stylish apparel and cloth wear, which has propelled the demand for fancy apparel. Moreover, kids' fashion shows are increasing across the globe as parents today are getting more aware through the internet in order to update the latest fashion for the kids. Various exhibitions are held across the globe in order to promote the kid's fashion and launch new fashions, especially for kids. For instance, ‘World of Childhood 2020’, a specialized exhibition to launch new products for infants, toddlers, and kids, is going to be held in June 2020 in Yerevan, Armenia.

内衣巴布y apparel is expected to expand at the fastest CAGR of 5.8% from 2019 to 2025. Over the past few years, the parents are concerned about the adverse effects on the baby’s health due to the presence of harmful chemicals present in the clothes. Sometimes, these clothes lead to skin irritation and many types of health and hygienic problems including rashes. As a result, the parents are expected to increase their spending on those underwear variants, which would provide protection against bacteria and viruses.

Distribution Channel Insights

如果线下分销渠道为主bal baby apparel market in 2018, accounting for more than 75.0% share of the global revenue. Major retailers including Carter's, Inc.; Cotton On Group; Hennes & Mauritz AB; Gerber Childrenswear LLC; and Naartjie are increasing the penetration of retail stores in order to cater to the increasing demand for baby apparel. For instance, as of 2018, Carter's, Inc., one of the largest designers and marketers of kids apparel, had more than 1,000 official stores in North America and more than 17,000 wholesalers in the U.S.

The online channel is expected to expand at the fastest CAGR of 6.1% from 2019 to 2025. With the growing population accessing the internet, the parents are getting more updates on the latest fashion from the social media websites such as Facebook, Instagram, Pinterest, and other media platforms. In addition, continuous promotions of the e-commerce websites such as Flipkart, Amazon, and Alibaba, coupled with great discounts offered by them, are increasing the adoption of online shopping among parents across the globe. Moreover, this distribution channel provides a platform for new entrants to the industry to promote and sell their products across the globe irrespective of their geographic boundaries.

Regional Insights

North America dominated the global with exceeding 40.0% share of the global revenue in 2018. The region is expected to maintain its lead over the next few years as a result of increased awareness among U.S.-based working-class parents regarding providing safety and hygiene to their babies.

Asia Pacific is expected to expand at the fastest CAGR of 6.7% from 2019 to 2025. Countries such as India and China accounted for the major share as the birth rates in these countries are high as compared to the rest of the world as a result of an improved childcare facilities in rural and urban areas. This trend is expected to play a crucial role in expanding the scope of baby apparel products.

The Middle East and Africa are expected to witness significant growth in the coming years. Urbanization and improvement in economic indicators in terms of rising disposable income and increase in the birth rate in African countries including Nigeria, Ethiopia, and Kenya are expected to open new avenues for baby apparel over the next few years.

Baby Apparel Market Share Insights

Key baby apparel manufacturers include Carter's, Inc.; Cotton On Group; Hennes & Mauritz AB; Nike, Inc.; Gymboree Group, Inc.; Industria de Diseño Textil, S.A.; and Naartjie. Major manufacturing firms are adopting several strategies including new product launches and promotion of offline and online sales in order to attract customers. For instance, in October 2018, Carter's, Inc., one of the largest designers and marketers of kids apparel, announced to launch of an annual campaign through an offline store and e-commerce portals in support of ‘Pajama Program’, a national nonprofit organization that promotes the pajamas as comforting sleepwear exclusively for babies and young children. Moreover, in November 2018, Carter's, Inc., announced to launch of the latest collection of apparel specially designed for premature babies under five pounds.

ReportScope

Attribute |

Details |

Base year for estimation |

2018 |

Actual estimates/Historical data |

2015 - 2017 |

Forecast period |

2019 - 2025 |

Market representation |

Revenue in USD Million & CAGR from 2019 to 2025 |

Regional scope |

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa |

Report coverage |

U.S., U.K., Germany, France, China, India, and Brazil |

Country scope |

收入预测,公司份额,竞争的土地cape, growth factors and trends |

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization |

Segments Covered in the Report

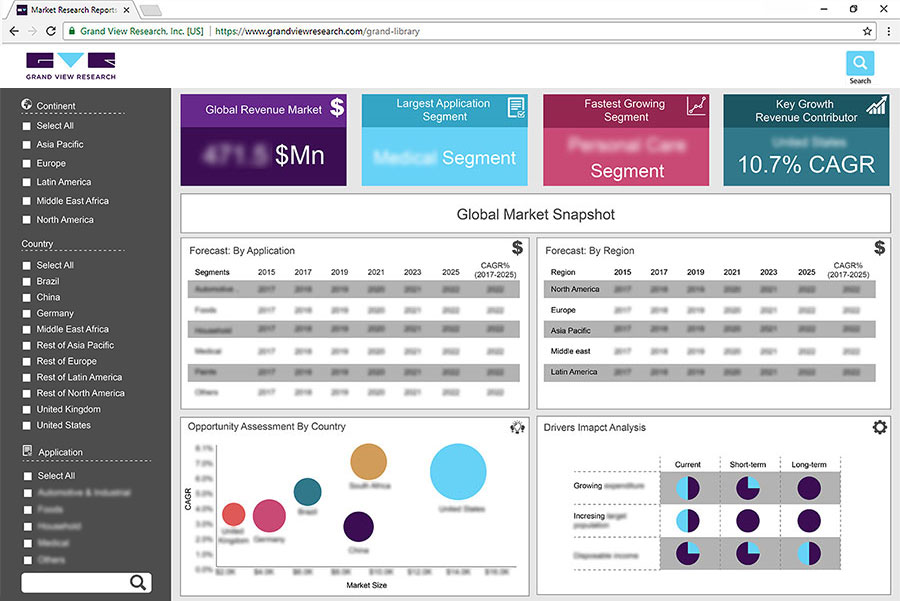

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global baby apparel market report on the basis of product, distribution channel, and region:

Product Outlook (Revenue, USD Million, 2015 - 2025)

Outerwear

Underwear

Distribution Channel Outlook (Revenue, USD Million, 2015 - 2025)

Online

Offline

Regional Outlook (Revenue, USD Million, 2015 - 2025)

North America

U.S.

Europe

U.K.

Germany

France

Asia Pacific

China

India

Central & South America

Brazil

Middle East & Africa