Carob Powder Market Size, Share & Trends Analysis Report By Product (Natural, Organic), By Application (B2B, B2C), By Region (North America, Europe, Asia Pacific, CSA, MEA), And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-216-7

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry:Consumer Goods

Report Overview

The global carob powder market size was valued at USD 47.2 million in 2019 and is anticipated to witness significant growth over the forecast period. Shifting consumers’ inclination towards healthier alternatives to cocoa powder is expected to expand the market scope over the next few years. Furthermore, carob powder finds its utility in the confectionery, bakery, and pet foods industries as it has a natural sweetening flavor and is rich indietary fiber.

Carob powder is high in calcium, fiber, and protein, and thus boasts various health benefits. Furthermore, the powder is considered to be vegan, gluten-free, caffeine-free, and naturally sweet, which eliminates the need to fortify it with sugar. Furthermore, carob contains virtually no saturated fat and no cholesterol owing to which it is gaining popularity among health-conscious consumers.

The rapid growth of the market is attributed to the caffeine-free property of carob powder, which makes it suitable for caffeine-intolerant consumers. Furthermore, the calcium content in carob powder is almost thrice the amount found in cocoa. This makes it exceptionally popular among women and those suffering from calcium deficiency.

As the vegan population continues to increase, the vendors across the world are launching vegan food products in various food categories to acquire greater market share. For instance, according to the Vegan Society, in 2018, the U.K. launched more vegan products than any other nation in the world. Additionally, orders of vegan meals grew 388% between 2016 and 2018 and it is among the fastest-growing food categories in U.K. Such factors are expected to expand the scope of carob powder as a vegan ingredient in formulation of various food products in the upcoming years.

Diabetic population is steadily increasing worldwide owing to a sedentary lifestyle and changing eating habits. For instance, according to the International Diabetes Federation, 463 million adults (20-79 years) were living with diabetes in 2019, which is expected to rise to 700 million by 2045. This scenario is expected to increase the application of carob powder as a natural sweetener, which eliminates the need to fortify with additional sugar.

Product Insights

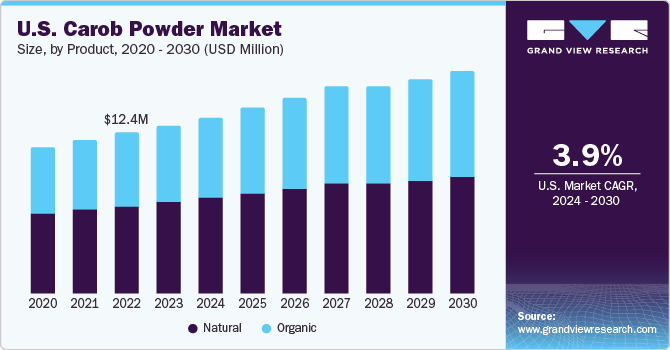

Natural products accounted for the largest share of 57.2% in 2019. This can be attributed to the wider penetration, popularity, and easy availability of natural carob powder, which is the raw material for artificial chocolates. Moreover, availability of natural carob powder at cheaper prices as compared to organic carob powder is a major factor driving the segment.

The organic segment is expected to register the fastest CAGR of 5.5% from 2020 to 2027. Demand for organic products is increasing mainly owing to the health benefits, less chemical usage, and changing lifestyle and food consumption patterns. Furthermore, increasing production, coupled with product availability, is a major factor contributing to the segment growth.

Application Insights

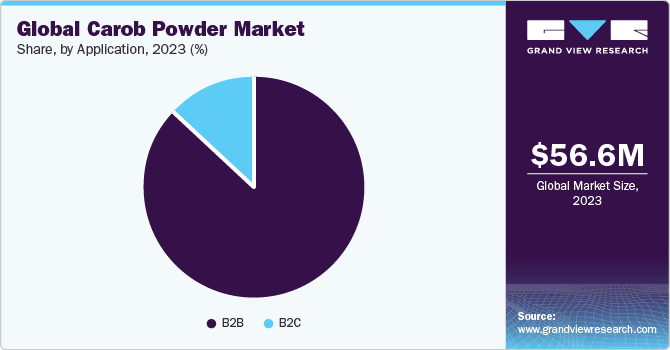

In terms of application, the B2B segment held a leading share of 87.7% in 2019. This is attributed to increasing application of carob powder in confectionery and bakery products. Over the past few years, the global bakery industry has been witnessing growth as the industry participants have been increasingly spending on the development of healthy baked goods and premium artisanal products. As a result, carob powder is expected to find utility as a functional ingredient in the manufacturing of these baked goods.

Over the past few years, consumers worldwide have been increasingly focusing on adopting a healthy lifestyle by shifting their preferences towards plant-based food and drinks and physical exercise. Moreover, increasing prevalence of lifestyle diseases, such as obesity, and cardiovascular diseases is expected to increase consumer awareness regarding weight management. This trend is expected to expand the carob powder market scope over the next few years.

Unsweetened carob chips contain about 70 calories per 2-tablespoon serving with 3.5 grams of fat, 7 grams of sugar, 50 grams of sodium, which makes them a convenient and all-inclusive food option. To gain a competitive edge, companies operating in the vegan and health supplements market are increasingly focusing on launching vegan and sugar-free food products, thereby contributing to the segment growth in the coming years.

The B2C segment is expected to exhibit the fastest CAGR of 6.7% over the forecast period. As consumers worldwide are becoming more interested in healthier food options, they have been practicing baking at home in order to avail of the actual nutrition benefits. This trend is expected to promote the utility of carob powder as baking agents in making home recipes over the next few years.

Regional Insights

Europe held the largest share of 40.2% in 2019. This is attributed to growing consumer interest in healthier alternatives to chocolate. Europe is among the largest consumers of chocolates andbakery productsin the world. Moreover, consumers are increasingly shifting towards plant-based or plant-derived products, leading to an increase in the vegan population. This is eventually fueling demand for carob powder in the region.

Asia Pacific is expected to expand at the fastest CAGR of 6.1% from 2020 to 2027. Growing popularity of carob powder owing to its rich nutritional content is the main factor driving the product demand in the region. Furthermore, growing availability of carob powder at supermarkets and hypermarkets will boost the demand in the coming years. Moreover, shifting consumer inclination towards sugar-free alternatives owing to growing prevalence of diabetes in countries, such as India and China, is expected to increase popularity of carob powder in the coming years.

Key Companies & Share Insights

Product innovation is expected to remain a key success factor for the global carob powder industry over the next few years. Over the past few years, the North American companies including Carobou, Missy J’s, Vukoo, Mocolate, and Uncommon Carob have been increasingly spending on the production and development of confectionery products derived from carob powder. Some of the prominent players in the carob powder market include:

THE AUSTRALIAN CAROB CO.

The Carob Kitchen

Frontier Co-op.

Oak Haven Inc.

Barry Farm Foods

NOW Foods

Ingredients UK Ltd.

Jedwards International, Inc.

OUASDI INTERNATIONAL

Alpine Herb Company Inc.

Carob Powder Market Report Scope

Report Attribute |

Details |

Market size value in 2020 |

美元49.3轧机ion |

Revenue forecast in 2027 |

USD 69.8 million |

Growth Rate |

CAGR of 5.0% from 2020 to 2027 |

Base year for estimation |

2019 |

Historical data |

2016 - 2018 |

Forecast period |

2020 - 2027 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2020 to 2027 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, application, and region |

Regional scope |

North America, Europe, Asia Pacific, Central & South America, and MEA |

Country scope |

U.S.; U.K.; Germany; China; Australia, Brazil, South Africa |

Key companies profiled |

THE AUSTRALIAN CAROB CO.; The Carob Kitchen; Frontier Co-op.; Oak Haven Inc.; Barry Farm Foods; NOW Foods; Ingredients UK Ltd.; Jedwards International, Inc.; OUASDI INTERNATIONAL; and Alpine Herb Company Inc. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global carob powder market report on the basis of product, application, and region:

Product Outlook (Revenue,USD’000, 2016 - 2027)

Natural

Organic

Application Outlook (Revenue,USD’000, 2016 - 2027)

B2B

Bakery

Confectionery

Others

B2C

Regional Outlook (Revenue, USD’000, 2016 - 2027)

North America

The U.S.

Europe

Germany

The U.K.

Asia Pacific

Australia

China

Central & South America

Brazil

Middle East & Africa

South Africa

Frequently Asked Questions About This Report

b.The global carob powder market size was estimated at USD 47.3 million in 2019 and is expected to reach USD 49.3 million in 2020.

b.全球角豆树粉市场预计的半夏ess a compound annual growth rate of 5.0% from 2020 to 2027 to reach USD 69.8 million by 2027.

b.Europe held the largest share of 40.2% in 2019 growing consumer interest towards healthier alternatives to chocolate on a regional level.

b.Some key players operating in the carob powder market include THE AUSTRALIAN CAROB CO., The Carob Kitchen, Frontier Co-op., Oak Haven Inc., Barry Farm Foods, NOW Foods, Ingredients UK Ltd., Jedwards International, Inc., OUASDI INTERNATIONAL, Alpine Herb Company Inc.

b.Key factors that are driving the market growth include caffeine-free property of carob powder, and growing demand for healthy foods.