日本威士忌市场规模、分享和趋势分析is Report By Distribution Channel (On-Trade, Off-Trade), By Application (Commercial, Residential), By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-4-68038-169-6

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry:Consumer Goods

Report Overview

The global Japanese whisky market size was valued at USD 600.2 million in 2018. While product demand continues to remain strong in Japan, interest in this variant has been growing around the globe. Factors such as increasing awareness regarding aged whisky and a growing taste for unique and imported spirits are driving the demand for Japanese whisky in the global alcohol market.

Rising inclination towards cocktail culture and experimental mixology act as an inspiration for consumers to opt for different alcoholic spirits. This scenario is thereby popularizing the market for Japanese whisky. In addition, the growth of different variants of whiskies in Japan and India has also drawn the attention of consumers towards high-quality spirits produced in these countries. Therefore, the market witnesses a growing prominence of Japanese whisky across cultures as a result of rising awareness towards different cultural alcoholic drinks.

The growing presence of bars and pubs across the globe has promoted the consumption of unique and imported liquors, such as Japanese whisky, across commercial establishments. The rising trend of Happy Hours offered by various commercial restaurants, pubs, hotels, and breweries serving alcohol is boosting the footfall of consumers. On the other hand, the rising popularity of home bars and interest in mixology is driving the consumption of Japanese whiskey in the residential sector.

Asia Pacific is the largest market for Japanese whiskey, attributed to the presence of the largest production facility in Japan and high product penetration in the region. Non-Japanese sales of Japanese whisky are high in France, China, the U.S., and the Philippines. While consumers initially came across the product only at Japanese restaurants or karaoke bars, product penetration across different verticals has ensured market growth.

Application Insights

The global Japanese whisky market is bifurcated into residential and commercial applications. Commercial applications contributed to the revenue's largest share of 78.3% in 2018. The increasing availability of alcohol in pubs, bars, clubs, lounges, hotels, and restaurants as an effort to attract a large mass of consumers is a major factor driving the sale of Japanese whisky. Using Japanese whiskey as a component in numerous cocktails is a popular trend at commercial establishments serving alcohol, driven by the growing interest in cocktail concoctions and experimental mixology. Social media has also played a major role in spreading awareness and increasing the popularity of Japanese whisky through posts and blogs.

The residential application segment is projected to exhibit a CAGR of 9.2% over the forecast period. The rising popularity of home bars and interest in mixology is driving the consumption of Japanese whiskey in the residential sector. Increasing exposure of consumers to imported whiskies thanks to a booming travel and tourism sector is also resulting in the growing demand for unique variants, including Japanese whisky.

Distribution Channel Insights

The on-trade segment reported a revenue of USD 399.5 million in the Japanese whiskey market in 2018 and is expected to witness significant growth over the forecast period owing to the increasing and easy availability of commercial establishments serving a variety of alcohol. The growth is also attributed to the rising per capita income of consumers, adoption of a luxurious lifestyle, and consumption of premium spirits in countries including the U.S., the U.K., Germany, India, and China. The rising trend of Happy Hours offered by various commercial restaurants, pubs, hotels, and breweries serving alcohol is boosting the footfall of consumers in such retail sectors. In addition, the trend of going out for a drink to celebrate a host of occasions across cultures, such as birthdays, anniversaries, promotions, festivals, and others, is increasing the prospects of consumption of Japanese whisky.

Off-trade distribution of Japanese whisky is projected to register a CAGR of 9.0% from 2019 to 2025. The trend of drinking at home - at smaller gatherings, low-key celebrations, and as part of daily meals - is gaining traction in many developing countries. This growing trend is supported by rising product access at retail shops as well as the availability of imported alcohol brands and types on online retail channels. This is paving the way for the consumption of Japanese whisky in the residential sector.

Regional Insights

Asia Pacific is the largest market for Japanese whiskey, accounting for 66.7% of the global revenue in 2018. This can be attributed to the presence of the largest production facility in Japan and high product penetration in the region. Population growth, urbanization, and rising disposable income in countries such as China, India, and Thailand are anticipated to play an important role in driving the overall alcohol market, having a positive impact on the consumption of Japanese whiskey in the coming years.

Local and international manufacturers are experimenting with various maturing techniques and the types of wood used to do the same, in order to gain an edge over the competition. For instance, Yoshino Spirits, one of Japan’s most diversified import and export spirit companies, introduced the Kamiki Sakura in 2019, signaling the extension of its Kamiki blended malt whisky range with a new and innovative expression. This variant is finished in Japanese cedarwood and is then transferred to casks made from Sakura wood, commonly known as Japanese cherry blossom, for further finishing. The exciting new notes lent by the Sakura wood have been very well received.

The North America and Europe markets together accounted for a little over 25.0% of the global market in 2018 and are expected to witness strong over the forecast period owing to an ongoing shift from beer and ciders to spirits. According to the WHO, the European region, including the European Union, reports the highest per capita alcohol consumption in the world. This trend is likely to have a positive impact on demand prospects for Japanese whisky.

Japanese Whisky Market Share Insights

The global market is highly competitive in nature. Top players operating in this space include Suntory Holdings Ltd., Nikka Whisky Distilling Co., Ltd., Chichibu Distillery, Venture Whisky, Ltd., FLAVIAR, Louisville Distilling Co. LLC, Asahi Breweries Ltd., Jf Hillebrand Japan Kk, Hombo Shuzo Co Ltd, and Yoshino Spirits. Companies are focusing on expanding their reach by producing a variety of Japanese whiskies in order to leverage the ongoing consumption trend across countries in Europe, North America, and Asia Pacific.

ReportScope

Attribute |

Details |

Base year for estimation |

2018 |

实际的估计/历史数据 |

2015 - 2017 |

Forecast period |

2019 - 2025 |

Market representation |

Revenue in USD Million & CAGR from 2019 to 2025 |

Regional scope |

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa |

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

Country Scope |

U.S., U.K., France, China, and Japan |

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

赛格ments Covered in the Report

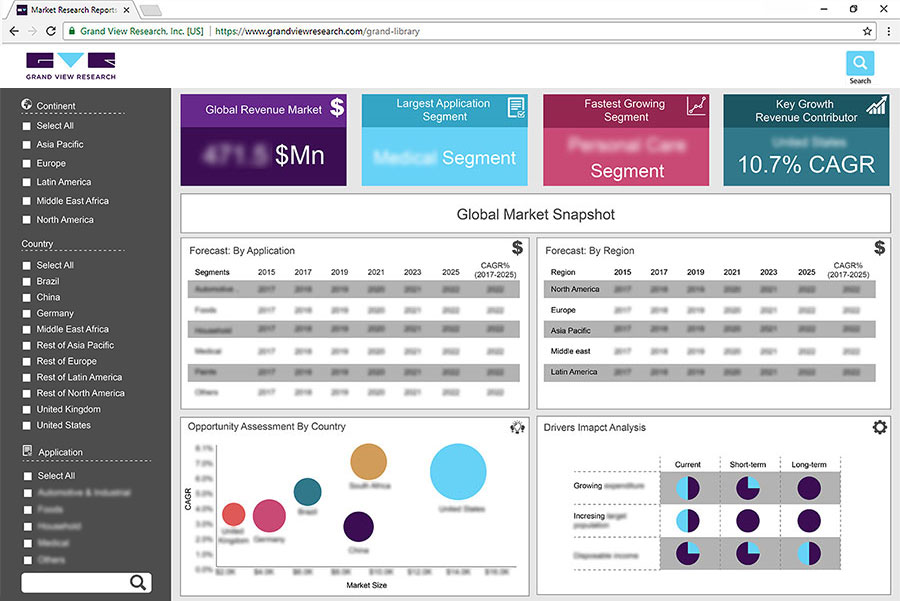

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global Japanese whisky market report on the basis of application, distribution channel, and region:

Application Outlook (Revenue, USD Million, 2015 - 2025)

Commercial

Residential

Distribution Channel Outlook (Revenue, USD Million, 2015 - 2025)

On-Trade

Off-Trade

Regional Outlook (Revenue, USD Million, 2015 - 2025)

North America

The U.S.

Europe

The U.K.

France

Asia Pacific

China

Japan

Central & South America

Middle East & Africa

Frequently Asked Questions About This Report

b.The global japanese whisky market size was estimated at USD 628.0 million in 2019 and is expected to reach USD 661.5 million in 2020.

b.The global japanese whisky market is expected to grow at a compound annual growth rate of 9.4% from 2019 to 2025 to reach USD 1.12 billion by 2025.

b.Asia Pacific dominated the japanese whisky market with a share of 65.5% in 2019. This is attributed to Population growth, urbanization, and rising disposable income in countries such as China, India, and Thailand.

b.Some key players operating in the japanese whisky market include Suntory Holdings Ltd., Nikka Whisky Distilling Co., Ltd., Chichibu Distillery, Venture Whisky, Ltd., FLAVIAR, Louisville Distilling Co. LLC, Asahi Breweries Ltd., Jf Hillebrand Japan Kk, Hombo Shuzo Co Ltd, and Yoshino Spirits

b.Key factors that are driving the market growth include increasing awareness regarding aged whisky and growing taste for unique and imported spirits.